Imagine launching your business in a hub that not only fosters growth with strategic advantages but also offers lucrative incentives. Abu Dhabi’s Free Zones provide a fertile ground for entrepreneurs and businesses aiming to tap into the Middle Eastern markets. Setting up in a Free Zone here could be your gateway to significant business opportunities, thanks to the region’s robust economic framework and investor-friendly climate.

You’ll find that each Free Zone in Abu Dhabi caters to specific industries, from media and finance to logistics and healthcare, ensuring that your business aligns with the most advantageous environment. Understanding the nuances of establishing your presence in these zones can help you leverage the full spectrum of benefits they offer, from tax exemptions to full foreign ownership. Let’s dive into what you need to know to make an informed decision about setting up in an Abu Dhabi Free Zone.

What Is a Free Zone?

A Free Zone, also known as a Free Trade Zone, is a designated area within Abu Dhabi where businesses can be established with special economic regulations that differ from the rest of the UAE. These regulations are designed to foster an environment that encourages business growth and international investment.

Key Benefits of Establishing in a Free Zone

Establishing your business in a Free Zone comes with several compelling benefits, each contributing to a streamlined and advantageous business environment:

- Zero Capital Requirements: No minimum capital requirement for most business activities.

- Full Foreign Ownership: Unlike other areas in the UAE, Free Zones allow 100% foreign ownership of companies, offering you complete control of your business.

- Ease of Setup: Free Zones provide a straightforward company setup process, with fewer restrictions and efficient administration.

- Access to Strategic Locations: Situated near ports and airports, Free Zones offer logistical advantages that can significantly reduce transportation costs.

The Concept Explained

The concept of a Free Zones is centered around creating an economically favorable environment specifically tailored for foreign businesses. This model not only attracts business ventures from around the globe but also facilitates easier entry into regional markets, aligning with Abu Dhabi’s vision to become an international business hub.

The Process of Setting Up a Freezone in Abu Dhabi

Establishing a business in a Free Zones in Abu Dhabi involves a streamlined process tailored to facilitate quick and effective business setup. This segment details the necessary steps and documents required to get your operations up and running in one of the city’s prime economic hubs.

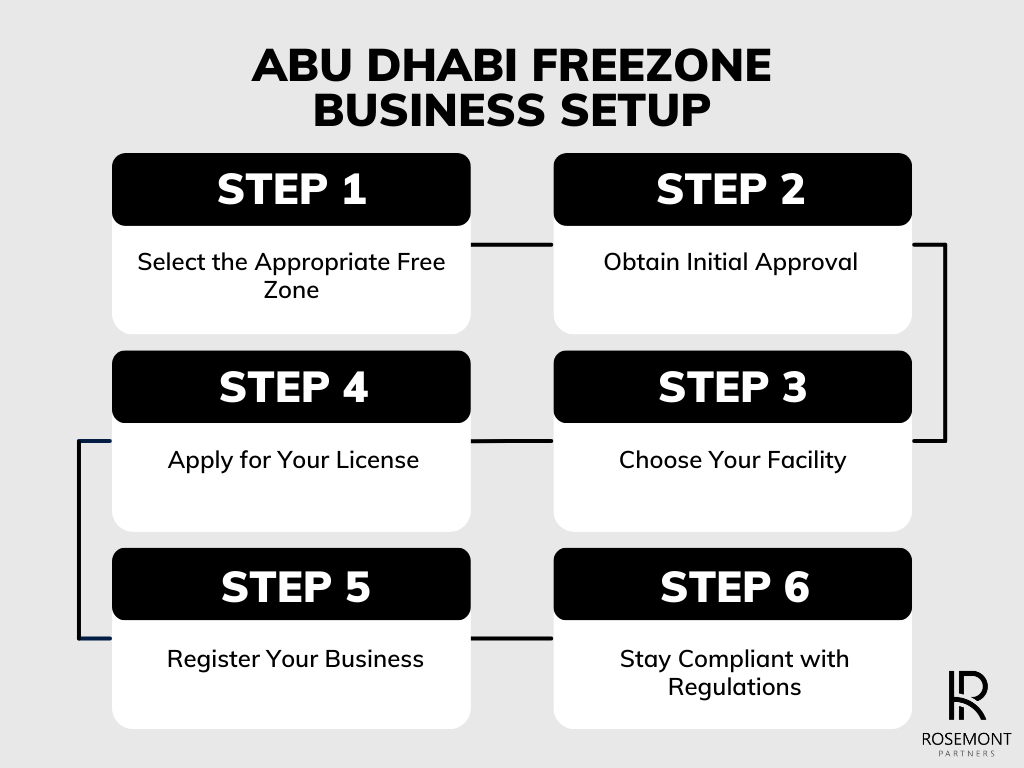

Step-by-Step Guide

- Select the Appropriate Free Zone: Each zone caters to specific industries, ensuring you choose one aligned with your business activity enhances growth opportunities. Zones like Masdar City are optimal for clean technologies, while Abu Dhabi Airport Free Zone supports logistics and aviation businesses.

- Obtain Initial Approval: Contact the Free Zone authority to express your intent and receive initial approval. This step involves submitting a business plan and choosing a legal structure for your company, such as a Free Zone Limited Liability Company (FZ-LLC).

- Choose Your Facility: Depending on your business needs, select from office spaces, warehouses, or land. The zone authorities offer various facilities designed to meet different business demands.

- Apply for Your License: Submit the completed application form along with the required documents to the Free Zone authority. License types vary—trade, service, industrial, among others—based on your business activities.

- Register Your Business: Once your license is approved, you can proceed with business registration. This includes registering any employees with the Free Zone authority and setting up corporate bank accounts.

- Stay Compliant with Regulations: Ensure compliance with local laws and regulations, including obtaining necessary permits and adhering to industry-specific guidelines.

Required Documentation

To smoothly navigate the setup process, having the correct documents is crucial. Below is a list of general documents you typically need to submit:

- Application Form: Completed and signed by the company’s legal representatives.

- Business Plan: Detailed description of your business activities, expected financial performance, and growth strategy.

- Copy of Passport: For all shareholders and the company’s director(s).

- Proof of Address: Recent utility bill or lease agreement in the name of the shareholder or director.

- Bank Reference Letter: Commonly required for each shareholder, from their respective banks.

- No Objection Certificate (NOC): If applicable, from the current sponsor for UAE residents serving as shareholders or directors.

Abu Dhabi’s Free Zones streamline procedures, making it easier for you to focus on what truly matters—growing your business. Gathering the right documentation and following these steps will ensure a seamless transition into your new business venture in Abu Dhabi.

Free Zones in Abu Dhabi and Their Respective Industries

Abu Dhabi is home to several key Free Zones, each designed to support specific industries by offering unique benefits, including streamlined regulations, and strategic locations. These Free Zones play a crucial role in attracting foreign investments and fostering business growth across various sectors such as finance, media, energy, logistics, and industry. Below is a closer look at the major Free Zones in Abu Dhabi and the industries they serve.

Abu Dhabi Global Market (ADGM)

ADGM is an international financial center that focuses on banking, finance, and investment. Known for its robust regulatory environment, ADGM supports a wide range of financial services, including fintech, asset management, insurance, and corporate banking. Offering unqiue license types, from financial, non- financial and Special Purpose Vehicles (SPVs). A good example of recent development is that the ADGM SPV is emerging to be one of the most preferred options for consolidating equity participations and investments in the region mainly due to the solid legal framework it offers as an ADGM SPV is governed by the English Common Law and has its own Courts similar to the DIFC.

Khalifa Economic Zone Abu Dhabi (KEZAD)

KEZAD is one of the largest industrial zones in the region, catering to industries such as manufacturing, logistics, and trade. With its strategic location near Khalifa Port, it provides businesses with world-class infrastructure and access to global markets, making it a prime destination for industrial development.

Masdar City

Masdar City is a hub for innovation in clean energy, sustainability, and green technologies. This Free Zones attracts companies and research institutions working on renewable energy solutions and environmental technologies, positioning itself as a leader in sustainable development.

Abu Dhabi Airports Free Zone (ADAFZ)

ADAFZ is strategically located around Abu Dhabi International Airport, serving industries such as aviation, aerospace, and logistics. This Free Zone offers businesses seamless connectivity to global markets and is a key location for companies involved in air transport and logistics services.

Twofour54

Twofour54 is Abu Dhabi’s dedicated Free Zone for media, entertainment, and creative industries. It supports businesses in film production, broadcasting, digital media, and advertising by providing cutting-edge facilities and attractive incentives for the creative sector.

Industrial City of Abu Dhabi (ICAD)

ICAD is focused on heavy industries, including metal fabrication, automotive, chemicals, and construction materials. This industrial zone is designed to support large-scale manufacturing and industrial activities, offering excellent infrastructure and proximity to key transportation links.

Legal and Regulatory Considerations

When setting up a business in Abu Dhabi’s Free Zones, understanding the legal and regulatory landscape is vital. This section delves into the pertinent legal framework and compliance needs that could impact your business operations.

Understanding Abu Dhabi’s Legal Framework

Abu Dhabi’s Free Zones operate under distinct legal regulations separate from the mainland legal framework. As an entrepreneur, you benefit from these tailored regulations which include 100% foreign ownership and no tax liabilities on personal income. Each Free Zone has its regulatory body, known as the Free Zone Authority (FZA), which oversees operations, issues business licenses, and ensures businesses adhere to the zone-specific rules. Engaging with the FZA early in the setup process ensures that your business aligns seamlessly with the legal requirements, helping to expedite your launch and operations within the zone.

Compliance and Regulatory Requirements

Compliance in Abu Dhabi Free Zones involves adhering to specific guidelines set forth by the respective Free Zone Authority. These include obtaining the right type of business license—be it for commercial, service-oriented, or industrial activities—and ensuring all business practices conform to established standards. Regular audits and compliance checks are routine, prioritising transparency and governance. Your business will also need to stay updated with changing regulations, potentially engaging legal and professional services to navigate complex areas such as import-export rules, employment laws, and data protection. These preparations ensure your business operates smoothly, remains compliant, and leverages the full advantages of the Free Zone infrastructure.

Conclusion

Abu Dhabi’s Free Zones offer a gateway to Middle Eastern markets and a globally competitive environment. With benefits like full foreign ownership and a simplified setup process, you’re well-positioned to launch and grow your business. Whether in technology, healthcare, or other sectors, these Free Zones provide the infrastructure needed for success. To navigate the legal and financial requirements smoothly, contact Rosemont Partners for expert guidance in setting up your company and seize the opportunity to thrive in one of the world’s most promising business hubs.