The UAE real estate market offers diverse investment opportunities in rapidly growing cities like Dubai and Abu Dhabi. Driven by local policies, global economic trends, and a growing expatriate population, this market provides both challenges and rewards. Whether you’re investing or relocating, understanding these factors is essential for making informed decisions in this dynamic landscape.

Overview of the UAE Real Estate Market

The UAE real estate market showcases significant growth and potential, characterised by its innovative infrastructure and appeal to international investors. This section delves into the current trends of the market and identifies the major players shaping its landscape.

Current Trends in the Market

The UAE real estate sector experiences several prevailing trends that directly impact investment and development opportunities. Firstly, there’s a notable shift towards sustainability, with more developers focusing on green buildings and eco-friendly materials. Examples include initiatives like Dubai’s Sustainable City. Secondly, technological integration in property management and real estate transactions has increased, facilitated by blockchain and AI technologies, providing enhanced transparency and efficiency. Lastly, the market sees a growing inclination towards affordable housing, responding to demands from a broader demographic of residents and younger buyers.

Major Players and Influences

Understanding the key stakeholders in the UAE real estate market reveals the drivers behind its dynamism. Major developers, such as Emaar Properties and Nakheel, dominate the landscape, continually expanding with innovative residential and commercial projects. Governmental policies also play a critical role, with initiatives aimed at boosting investor confidence and ensuring sustainable development. Additionally, the influx of international investors and changes in expatriate residency laws influence market trends and demand, highlighting the UAE’s strategic efforts to strengthen its real estate sector.

Key Drivers of the UAE Real Estate Market

In exploring the UAE real estate market, you’ll find it’s driven by various dynamic factors. Key elements include economic conditions and government interventions which significantly influence market trajectories and investment climates.

Economic Factors

The economic climate in the UAE plays a pivotal role in shaping the real estate sector. As an investor or potential resident, you can observe the direct correlation between the UAE’s GDP growth and real estate market health. High oil prices often boost economic confidence, leading to increased spending on real estate projects. In periods of economic expansion, sectors like tourism and retail witness growth, further spurring property demand in both commercial and residential spaces. Conversely, when the economy slows, it may temper market growth, but typically, real estate remains a strong investment in comparison to other assets.

Government Policies and Regulations

Government policies and regulations form the backbone of the real estate market’s operational environment in the UAE. The government has implemented numerous initiatives, such as long-term residency visas and laws on foreign property ownership, which attract international investors and stimulate market growth. Regulatory frameworks ensure quality control, sustainability standards, and investor protection, making the UAE a favourable environment for real estate development. Specific regulations like the Dubai 2040 Urban Master Plan, which focuses on enhancing urban areas and expanding green spaces, directly impact development trends and investment opportunities in the region.

Opportunities for Investment in the UAE Real Estate

The UAE real estate market offers intriguing opportunities ideal for diverse investment strategies. With its sophisticated infrastructure and stable investment climate, it’s a lucrative arena for prospective investors.

Hotspots for Investment

Dubai and Abu Dhabi remain the powerhouses of investment potential in the UAE real estate market. Properties in these urban centres experience consistent demand, marked by high rental yields and robust capital appreciation. In Dubai, districts like Marina, Downtown, and The Palm Jumeirah command attention with their luxurious amenities and impressive skyline views. These areas appeal significantly to high-net-worth individuals and expatriates looking for premium living options.

Abu Dhabi, with its strategic initiatives to boost economic diversification, has districts like Yas Island and Saadiyat Island that have become focal points for investors. These locations offer high-quality residential projects and entertainment amenities alongside promising financial perks, like higher returns on investments compared to global benchmarks.

Other emerging hotspots include Sharjah, known for its cultural significance and more affordable housing options, and the Northern Emirates, which provide good investment opportunities due to recent developmental projects.

Future Forecast for the Real Estate Market

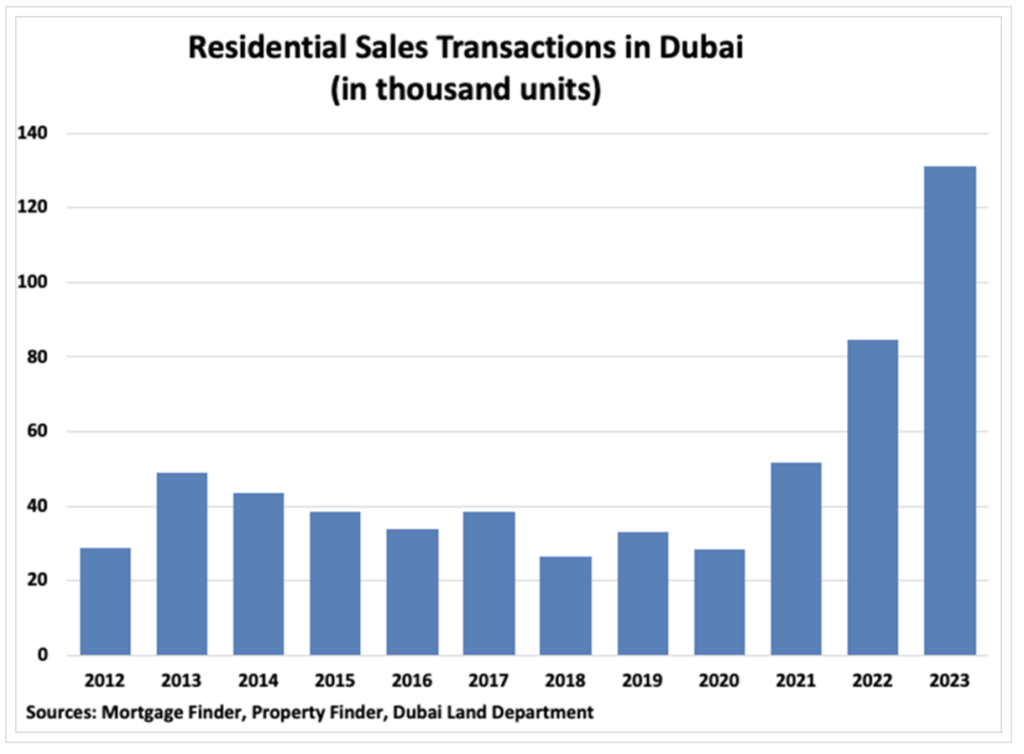

The outlook for the UAE real estate market remains positive, driven by continuous governmental initiatives aimed at attracting foreign investment and sustaining economic diversification. Forecasts indicate a steady increase in demand for residential properties, influenced by policies such as the introduction of long-term residency visas and changes to foreign ownership laws.

Additionally, the hosting of global events such as Expo 2020 has catalysed infrastructure developments, boosting the demand for both commercial and residential real estate. The commitment to sustainable development and smart city projects is expected to further enhance property values and offer new investment avenues in green buildings and technology-integrated properties.

Overall, despite occasional fluctuations and market adjustments, the sector’s fundamentals are solid, presenting an appealing prospect for both short-term gains and long-term investment returns.

Conclusion

Navigating the UAE real estate market presents promising investment opportunities, with robust growth and innovative developments in both Dubai and Abu Dhabi. Whether you’re a seasoned investor or new to the market, staying informed about evolving legal frameworks and market dynamics is key to success. Leveraging insights from government initiatives and global trends can help guide your investment decisions toward profitable outcomes. As the market focuses on sustainability and technology-driven solutions, the UAE real estate sector is thriving. For expert guidance on making the most of these opportunities, contact Rosemont Partners to help you navigate your next great investment.